FX - Monitor: Volatility and Momentum

USD bullish breadth; CHFJPY bullish

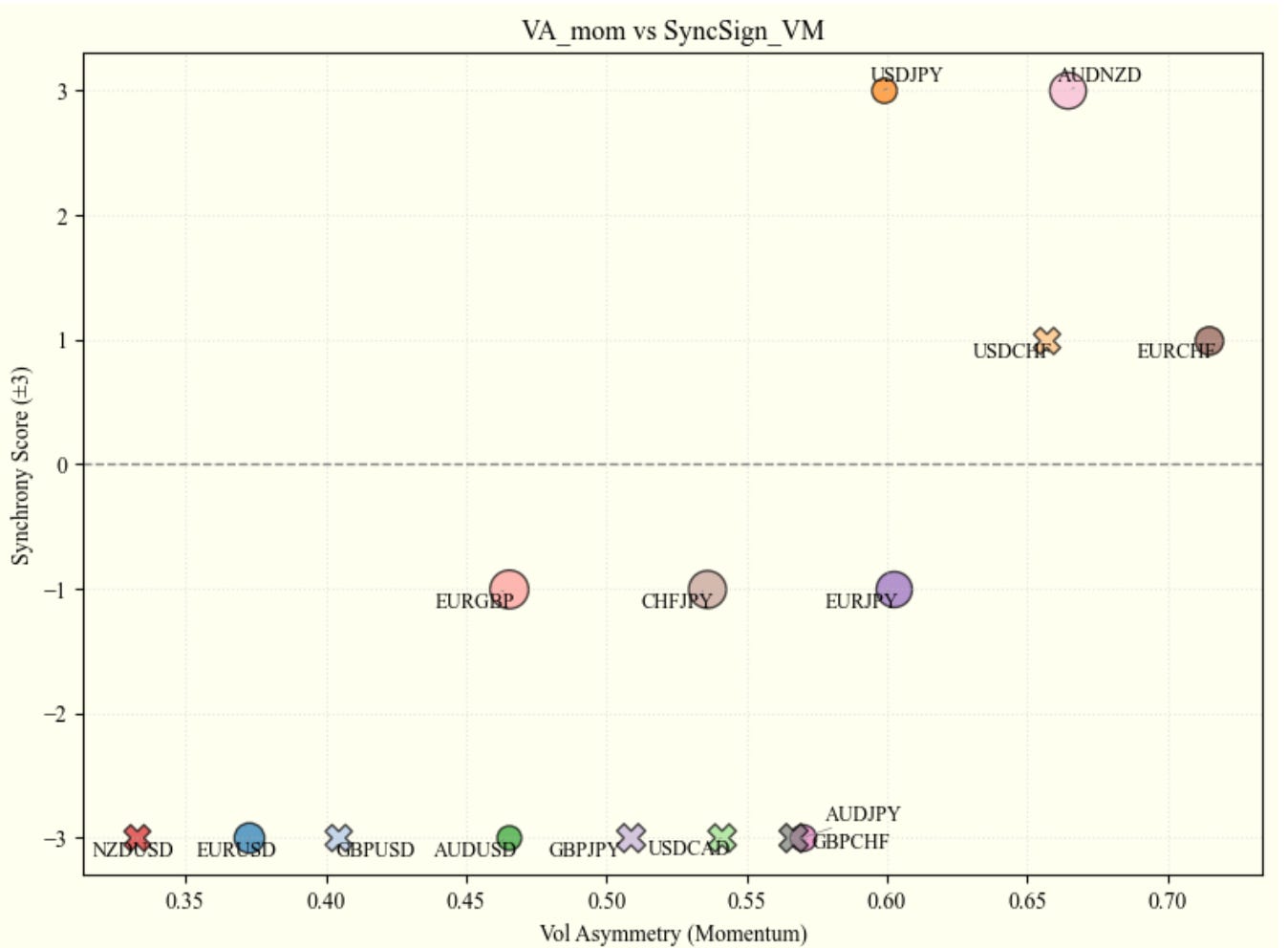

Below we map major currency pairs, the shape denote the rate-of-change of the currency’s momentum score, if it is circular the ROC is positive; cross, negative.

The size of the dot represents the value of the currency’s momentum score rate-of-change.

Volatility asymmetry measures the degree to which volatility of momentum is lopsided, if the volatility is mostly on the downside, it will be negative; if on the upside, positive.

The synchrony score represents the robustness of the trend for said volatility.

Below, we see volatility is increasingly on the downside for crosses against USD.

We see USD is strengthening against JPY, with a robust trend offering more upside than downside.

We see USDCHF and EURCHF are mildly bullish, but USDCHF ROC has turned negative - worth observing for news.

CHFJPY is similarly strengthening and has recently crossed the 0.5 line, above 0.5 and volatility is no longer even-keeled - this is a necessary condition for a rally. Bullish, I’d say - again, watch for news.

Below I post a series of charts with a trend score, and it’s moving average, and major FX crosses. I’d advise cross-referencing interesting plots on the scatter with the price charts below. Extrema are always worth paying attention to.

Keep reading with a 7-day free trial

Subscribe to Mary Mount Research to keep reading this post and get 7 days of free access to the full post archives.